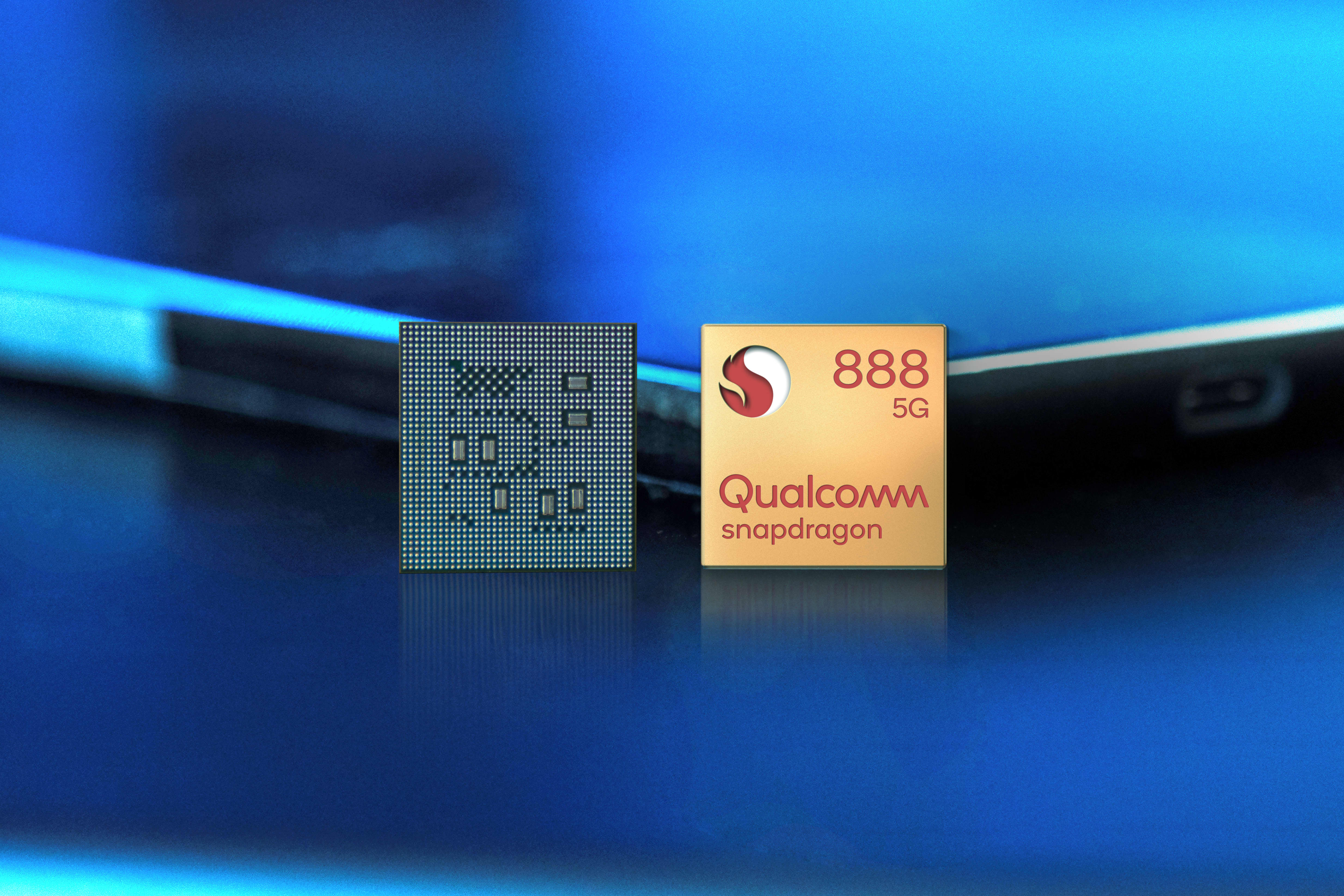

A fresh batch of earnings are set to come out next week, ranging from Big Tech companies to major pharmaceutical names, and analysts think some names could post stand-out results. Roughly 19% of S & P 500 companies are set to report next week, including megacap names such as Apple, Microsoft and Amazon. Thus far, about 22% of companies have reported earnings for the fourth quarter, with nearly 74% of those names surpassing expectations, FactSet data shows. Against this backdrop, CNBC Pro looked for S & P 500 names reporting next week that made the following criteria: They have at least five upward earnings-per-share estimate revisions in the past three months. Their average EPS estimates are up 5% or more in the past three months. The average price target of these companies has increased by 5% or more, according to FactSet. Take a look at the names that made the list: Analysts have gotten increasingly bullish on Amazon over the past few months, as the stock rallied 80% last year for its biggest annual increase since 2015. Earnings per share estimates are up about 20% in the past three months, after having received more than 45 upward revisions from analysts. According to FactSet, the consensus price target of $184.10 suggests an upside of nearly 17.4% from Wednesday’s close. On Thursday, Jefferies analyst Brent Thill raised his price target by $15 to $190, suggesting shares could jump as much as about 21%. “Inflecting [Amazon Web Services] growth and continued margin improvement should support the next leg of outperformance for AMZN,” Thill wrote in a Thursday note, adding that “recent layoffs signal to us that AMZN is committed to ‘Harvest Mode’ as they continue to optimize the cost structure.” From the end of 2022 and throughout through 2023, Amazon implemented its largest layoffs efforts in its history, cutting more than 27,000 jobs in nearly every part of the company. Most recently, Amazon trimmed its Prime Video and MGM Studios divisions. Shares of Amazon are up about 2.7% for the year so far, but have lagged gains by tech peers Microsoft , Alphabet and Meta Platforms , which have all added more than 7%. The company is reporting earnings on Feb. 1. Analysts have also raised their estimates on Royal Caribbean , which is set to report on Feb. 1. Nearly 20 analysts have revised their quarterly earnings estimates upward. Overall, earnings per share estimates for the cruise line operator are up more than 6%. Analysts have gotten increasingly bullish on Royal Caribbean’s newest megaship, Icon of the Seas, that debuts on Jan. 27 and the company’s land-based attractions added onto its ships and private islands. Increased demand for cruise travel has also lifted investor sentiment on the stock. Shares are down 2.1% for the year, but gained about 1% on Thursday. Of this list, Qualcomm , has seen the highest price target change in the past three months, at 10.5%. The semiconductor development company is set to report earnings Jan. 31. Bank of America is bullish on the company’s quarterly results, noting that the stock has increased more than 40% in the last three months on better demand and inventories. “We expect solid 1Q24 results, driven by continued improvements in Android handset demand and better channel inventories,” analyst Tal Liani wrote in a Thursday note. Other companies that have earnings momentum heading into next week include Hartford Financial Services and A. O. Smith Corporation , both of which have received roughly 20 earnings estimate revisions in the past three months.