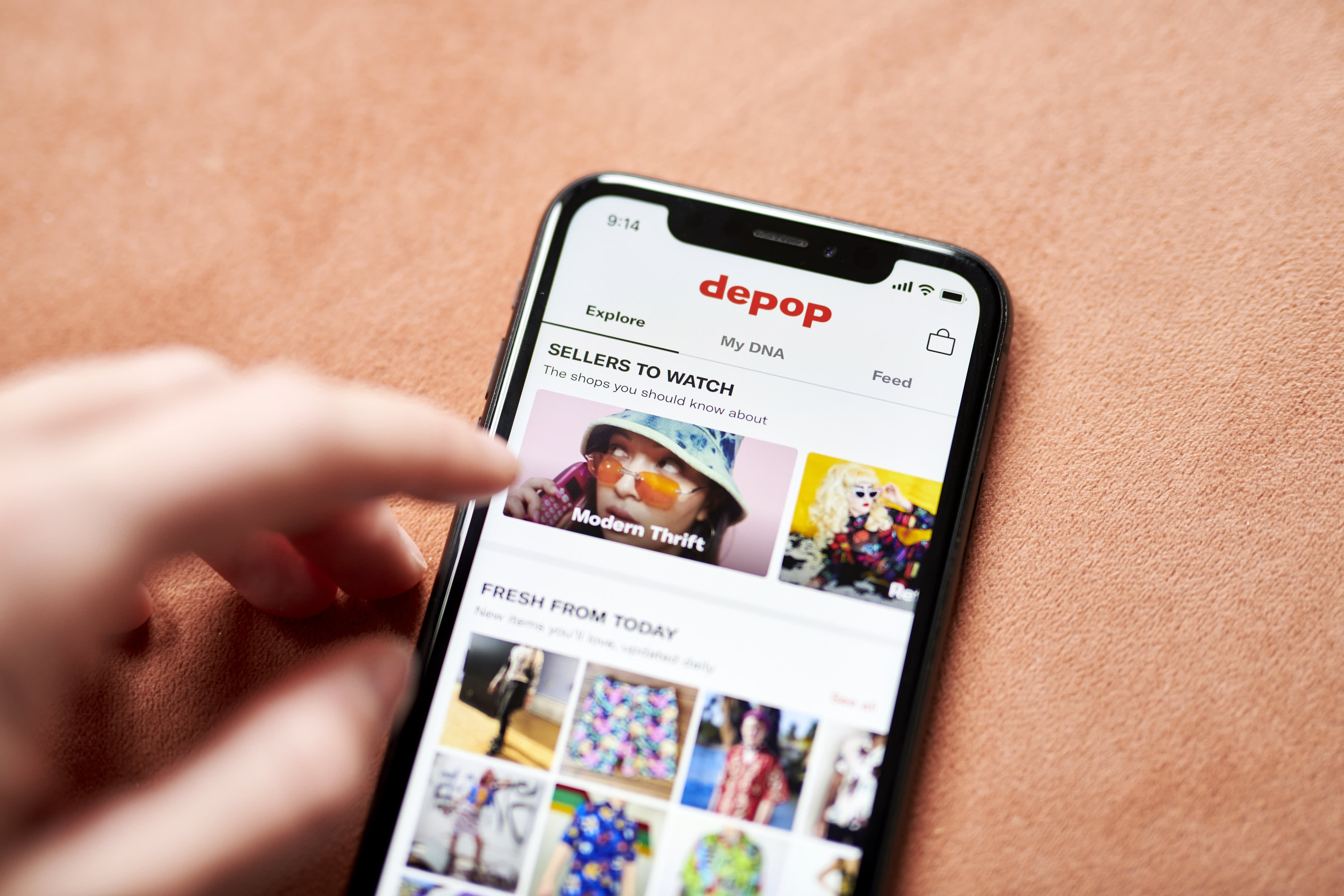

The Depop application on a smartphone arranged on Wednesday, June 2, 2021.

Gabby Jones | Bloomberg | Getty Images

Six months after launching his secondhand clothing shop on digital marketplace Depop in 2020, Blake Robertson, a 15-year-old high schooler at the time, received a death threat from a customer.

It came via Instagram, from someone who had not received her purchase in time for Christmas.

“Nothing happened, but I don’t know, it just opened my eyes to the fact that some people, they just really want their items,” said Robertson.

Demand for secondhand resale has been booming since the early days of the pandemic, generating a culture shift within the indie marketplaces where it all began. Customers, many of whom have been feeling the squeeze of inflation, are fiending for lower prices, leading to more heated negotiations and occasionally ruthless bidding wars.

Meanwhile, independent resellers are turning their one-time hobby into a job, sometimes even upselling items to take advantage of demand spikes. Users on platforms like Depop and Poshmark set up online shops to list vintage, secondhand or unique items for sale and generate notable followings of loyal shoppers.

Robertson is now 17 and says the growth of resale has allowed him to turn his Depop shop, which now has over 19,000 followers, into a part-time gig. He told CNBC he juggles the hustle of reselling with his high school studies.

Blake Robertson, 17, poses with his closet, some of which is up for resale on his Depop shop.

Courtesy: Blake Robertson

He’s become accustomed to the occasional hate message or days-long negotiations over a single item. More than anything, he has been pleasantly surprised by the growing reach of his shop, which used to just serve his friends as patrons.

“I get these messages from total and complete strangers, which just makes me think how much this app genuinely has grown,” Robertson said.

The back and forth

To be sure, death threats against resellers are not the norm. Beaux Abington, 49, says that overall, she’s had “really fantastic, phenomenal customers.”

But she’s also noticed more buyers hunting deals, and has felt insulted by recent offers for her products that are sometimes less than half her asking price.

“There’s definitely a price-consciousness that wasn’t always there,” said Abington.

About 53% of people polled in an October 2022 Depop survey of over 2,000 U.K. consumers said that they have been turning to secondhand shopping more in order to save money as living costs rise. The result, sellers say, is more frequent negotiations and intensified bidding wars.

“There’s a lot more negotiation happening. Even in the last year, I’d say it’s kind of skyrocketed for me,” said Josefina Munroe, 27, a Depop seller with over 30,000 followers. She started her shop five years ago and decided to make it a full-time job after she graduated college in 2020 and demand for online resale expanded.

Then there are the de facto bidding wars. Munroe recalls purchasing an item on Depop, only to have the seller cancel her order after realizing that another customer was willing to pay more. Other Depop shoppers say that is not an uncommon experience.

“It’s completely separate from real-world shopping because that would never happen in a store,” said Munroe. “I think people have gotten very comfortable with the whole back and forth.”

Beaux Abington, 49, models some of her own Depop items.

Courtesy: Beaux Abington

Platforms like Depop and Poshmark are leaning into the competitive consumer zeitgeist.

Last January, Depop launched a new “Make Offer” option – a feature that has streamlined the negotiation process, which used to take place informally via direct messages. Resellers say that the new button has made customers more comfortable haggling.

“The offer feature on Depop has definitely created a new dynamic in terms of being hounded with low-ballers and also being expected to sell things cheaply,” said Pascale Davies, 28, who runs a Depop shop with 59,000 followers.

But Depop has yet to institute a formal function for bidding battles — like the original reseller, eBay, offers. Depop also shut down comment sections on product pages where customers used to ask questions and sometimes get in arguments, according to users.

“We found that comments on an item did not directly help buyers with their decision-making,” a Depop spokesperson told CNBC when asked about the change.

Going bigger

In September, Poshmark launched “Posh Shows,” which allows sellers to hold livestreamed auctions to sell and promote their inventory.

Stephanie Dionne, 44, who has been selling on Poshmark for about two years, said that the live shows are “all kinds of crazy and chaotic,” generating a fast-paced, ruthless selling environment.

“When it comes to the live shows, people will kind of steal it out from under you at the last second,” she said.

Since launching her secondhand market with her two sisters, Dionne’s business keeps getting bigger and bigger – so much so that one of her sisters reduced her full-time day job to part-time in order to focus on the Poshmark shop.

Last year, the Dionnes made between $4,000 and $5,000 in profit. Just a couple months into this year, they have already surpassed that.

But now, sellers like the Dionnes are not only competing with Poshmark and Depop peers, but also major retailers like Target and H&M trying to cash in on the resale boom.

Last week, H&M announced its most recent collaboration with the online thrift store ThredUp, which will now cross-list about 30,000 pieces of secondhand clothing on H&M’s website. Target has launched several ThredUp partnerships of its own, and Etsy bought Depop back in 2021. This January, Poshmark was acquired by South Korean web giant Naver.

But some independent resellers doubt that the unique, curated experience of indie resale can be scaled.

“Although bigger companies are trying to occupy this space, I think they miss the mark when it comes to the personal element of vintage,” Finn Thomas, a London-based Depop seller, told CNBC.

“Part of the charm of buying vintage is the one-on-one interaction between the buyer and seller, the unique story behind each piece and the general curation behind a store, something I can’t see the larger companies like H&M achieving,” Thomas added.