Inflation showed further signs of cooling in June, according to a gauge released Friday that the Federal Reserve follows closely.

The personal consumption expenditures price index excluding food and energy increased just 0.2% from the previous month, in line with the Dow Jones estimate, the Commerce Department said.

related investing news

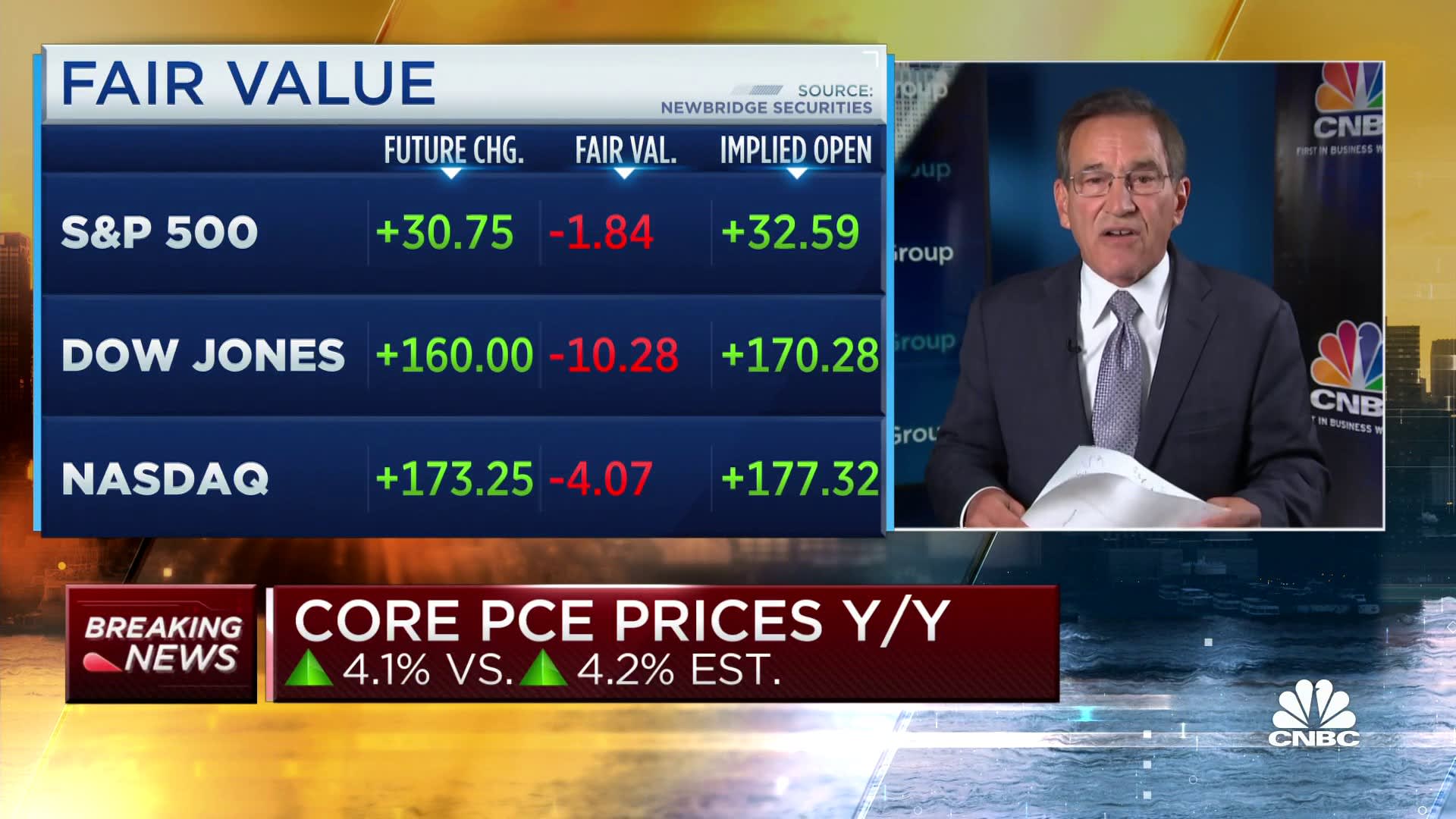

So-called core PCE rose 4.1% from a year ago, compared with the estimate for 4.2%. The annual rate was the lowest since September 2021 and marked a decrease from the 4.6% pace in May.

Headline PCE inflation including food and energy costs also increased 0.2% on the month and rose 3% on an annual basis. The yearly rate was the lowest since March 2021 and moved down from 3.8% in May.

People shop in a Manhattan store on July 27, 2023 in New York City.

Spencer Platt | Getty Images

Goods prices actually decreased 0.1% for the month while services rose 0.3%. Food prices also fell 0.1%, while energy increased 0.6%.

Markets reacted positively to the report, with stock market futures pointing higher and Treasury yields headed lower.

“Today’s economic releases reaffirm the current market narrative that inflation is cooling and economic growth is continuing, which is a favorable environment for risk assets,” said George Mateyo, chief investment officer at Key Private Bank. “The Fed and investors will take comfort in these numbers as they suggest that the inflation threat is dissipating and thus the Fed may now be able to go on vacation and assume an extended pause with respect to future interest rate increases.”

The data reinforces other recent releases showing that, at least compared with the soaring inflation from a year ago, prices have begun to ease. Readings such as the consumer price index are showing a slower rise in inflation, while consumer expectations also are also coming back in line with longer-term trends.

Fed officials follow the PCE index closely as it adjusts for changing behavior from consumers and provides a different look at price trends than the more widely cited CPI.

Along with the inflation data, the Commerce Department said personal income rose 0.3% while spending increased 0.5%. Income came in slightly below expectations, while spending was in line.

The report comes just two days after the Fed announced a quarter percentage point interest rate increase, its 11th hike since March 2022 and the first since skipping the June meeting. That took the central bank’s key borrowing rate to a target range of 5.25%-5.5%, its highest level in more than 22 years.

Following the hike, Fed Chairman Jerome Powell stressed that future decisions on rate moves would be based on incoming data rather than a preset course on policy. Central bank officials generally believe that inflation is still too high despite the recent positive trends and want to see multiple months of solid data before changing direction.

A separate indicator that the Fed follows closely showed that compensation costs increased a seasonally adjusted 1% on an annual basis during the second quarter. That reading for the employment cost index was slightly below the 1.1% estimate.