97 / Getty

Inflation has throttled back significantly since peaking two years ago. The U.S. economy is even seeing some prices deflate for consumers.

Deflation measures how quickly prices are falling for a consumer good or service. It’s the opposite of inflation, which gauges how quickly prices are increasing.

Physical goods have accounted for much of the deflation over the past year, according to economists. This is happening as supply and demand dynamics that were thrown out of whack in the pandemic normalize.

Commodity prices (excluding those related to food and energy) — so-called “core” goods — have declined by 1.8%, on average, since June 2023, according to the consumer price index, a key inflation measure.

“We have seen core-goods deflation in quite a few categories,” according to Olivia Cross, a North America economist at Capital Economics.

“It’s quite broad based,” she added. “I think that’s something we expect to persist for a little while.”

Prices on gasoline and many grocery items have also pulled back.

However, consumers shouldn’t expect a broad and sustained fall in prices across the U.S. economy. That generally doesn’t happen unless there’s a recession, economists said.

Why prices are deflating for goods

Demand for physical goods soared in the early days of the Covid pandemic as consumers were confined to their homes and couldn’t spend on things such as concerts, travel or dining out.

The health crisis also snarled global supply chains, meaning goods weren’t hitting the shelves as quickly as consumers wanted them.

Such supply-and-demand dynamics drove up prices.

The environment has changed, though: The initial pandemic-era craze of consumers fixing up their homes and upgrading their home offices has diminished, cooling prices. Supply-chain issues have also largely unwound, economists said.

Since June 2023, consumers have seen prices deflate for goods like home furniture for a living room, kitchen or dining room (down by 4.9%), appliances (-3.6%), toys (-6%), dishes and flatware (-10.2%) and outdoor equipment like grills and garden supplies (-4.3%).

More from Personal Finance:

High inflation largely not Biden’s, Trump’s fault: economists

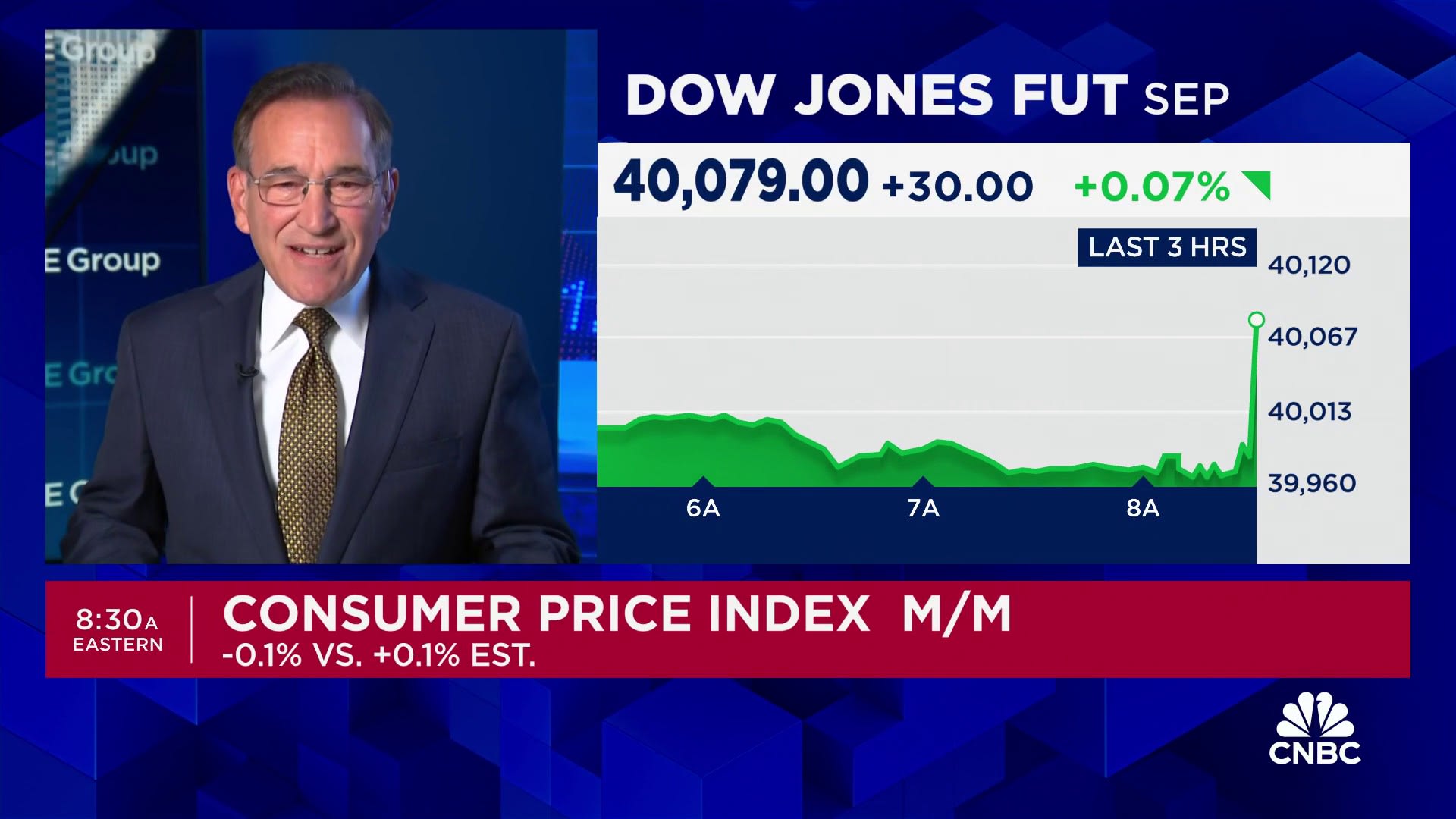

Here’s the inflation breakdown for June 2024 — in one chart

Here’s why housing inflation is still stubbornly high

Car buyers have also seen prices for new vehicles fall more than 1% and for used vehicles by roughly 10% over the past year. Vehicle prices were among the first to surge when the economy reopened broadly early in 2021, amid a shortage of semiconductor chips essential for manufacturing.

“Vehicle prices remain under pressure from improved inventory and elevated financing costs,” Sarah House and Aubrey George, economists at Wells Fargo Economics, wrote in a note this week. (Higher financing costs are the result of the Federal Reserve raising interest rates to tame inflation.)

Outside of supply-demand dynamics, the U.S. dollar’s strength relative to other global currencies has also helped rein in prices for goods, economists said. This makes it less expensive for U.S. companies to import items from overseas, since the dollar can buy more.

Long-term forces like globalization have also helped, such as importing more lower-priced goods from China, Cross said. However, a shift toward higher tariffs and less free trade could serve to push up goods prices “quite significantly,” she added.

Why there’s been deflation for food, travel, electronics

Prices have also declined for items including food, travel and electronics.

Grocery prices have fallen for items such as ham, rice, potatoes, coffee, milk and cheese, according to CPI data.

Each grocery item has their own supply-and-demand dynamics that can influence pricing, economists said. For example, apples prices are down 12% in the past year due to a supply glut, while egg prices surged in 2022 due largely to a historic and deadly outbreak of bird flu.

Gasoline prices have fallen by 2.5% in the past year. Weaker recent prices were the result of “tepid gasoline demand, increasing supply, and falling oil costs,” according to AAA.

Travelers have seen deflation for airline fares (prices are down 5.1% annually) amid factors like an increased volume of available seats. Hotel rates are also down, by 2.8%, and car rental rates by 6.3% since June 2023.

Consumers also appear to be more price sensitive, which has caused retailers to be a bit more cautious, economists said.

For example, there have been more price promotions lately at grocery stores, with a few “major retailers recently announcing price cuts that are likely to pressure competitors’ pricing,” wrote House and George of Wells Fargo.

Elsewhere, some deflationary dynamics may be happening only on paper.

For example, in the CPI data, the Bureau of Labor Statistics controls for quality improvements over time. Electronics such as televisions, cellphones and computers continually get better, meaning consumers generally get more for the same amount of money.

That shows up as a price decline in the CPI data.