Delta Air Lines won’t expand flying in the second half of the year because of disappointing bookings amid President Donald Trump‘s shifting trade policies, which CEO Ed Bastian called “the wrong approach.”

The carrier said it is too early to update its 2025 financial guidance, a month after it confirmed the targets at an investor conference, though Delta said Wednesday it still expects to be profitable this year. Last month, Delta cut its first-quarter earnings outlook, citing weaker-than-expected corporate and leisure travel demand.

It is a shift for Delta, the most profitable U.S. airline, which started 2025 upbeat about another year of strong travel demand, with Bastian predicting it would be the “best financial year in our history.”

Bastian’s new comments show growing concern among CEOs about consumers’ souring appetites for spending and the impact of some of Trump’s policies. In November, Bastian said the Trump administration’s approach to industry regulation would likely be a “breath of fresh air.”

Wall Street analysts have slashed their earnings estimates and price targets for airlines in recent weeks on fears of slowing demand.

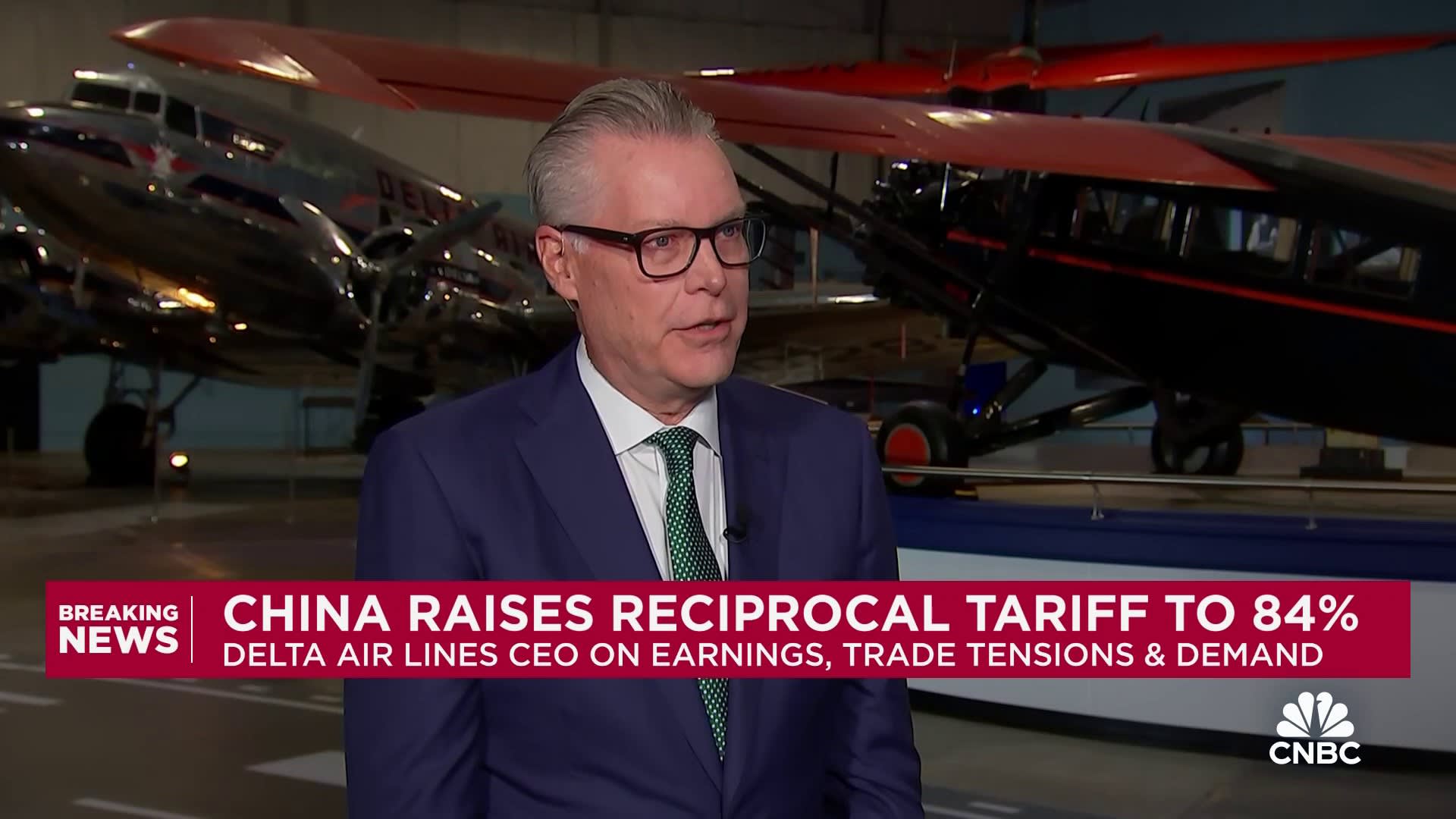

“In the last six weeks, we’ve seen a corresponding reduction in broad consumer confidence and corporate confidence,” Bastian told CNBC. He said that demand, overall, was “quite good” in January and that things “really started to slow” in mid-February.

Bastian said main cabin bookings are weaker than previously expected. He said that travel demand that was growing about 10% at the start of the year has since slowed because some companies are rethinking business trips, the Trump administration has cut the government workforce and markets are reeling. The White House didn’t immediately respond to a request for comment.

Bastian said international and premium travel, which has been growing faster than sales from the coach cabin, have been relatively resilient.

Delta planned to expand flying capacity by about 3% to 4% in the second half of 2025, Bastian said in an interview. Now the carrier’s capacity will be flat year over year.

Delta Air Lines planes are seen parked at Seattle-Tacoma International Airport on June 19, 2024 in Seattle, Washington.

Kent Nishimura | Getty Images

“We expect this to be the first of many 2H25 capacity reduction announcements from the airlines this quarter,” TD Cowen airline analysts Tom Fitzgerald and Helane Becker wrote after Delta released its outlook.

Some of the future capacity cuts could include Canada, where U.S.-bound travel has declined, and Mexico, Delta President Glen Hauenstein said. For Mexico, he said there is less demand for travelers visiting friends and family rather than a drop in business travel.

“With broad economic uncertainty around global trade, growth has largely stalled,” Bastian said in Wednesday’s earnings release. “In this slower-growth environment, we are protecting margins and cash flow by focusing on what we can control.”

Delta is the first of the major U.S. carriers to report earnings. United, American, Southwest and others are scheduled to report later this month.

Tariffs and potential retaliatory duties could drive up the costs of imported components for the U.S. aerospace industry.

Delta’s Bastian, however, said the company will defer any Airbus aircraft that is affected by tariffs. Airbus produces airplanes in Europe but also uses imported components in its Mobile, Alabama, factory.

Delta’s stock, along with other airlines, rallied after Trump’s surprise announcement that he would lower some tariff rates for 90 days. Its shares rose more than 23% though they’re still down almost 27% this year.

Here’s how the company performed in the three months ended March 31, compared with what Wall Street was expecting, based on consensus estimates from LSEG:

- Earnings per share: 46 cents adjusted vs. 38 cents expected

- Revenue: $12.98 billion adjusted vs. $12.98 billion expected

In the first quarter, Delta’s net income rose to $240 million, up from $37 million last year, with revenue up 2% year over year to $14.04 billion.

Stripping out Delta’s refinery sales, Delta posted adjusted earnings per share of 46 cents, up 2% from last year and above analysts’ expectations, and adjusted revenue of $12.98 billion, up 3% from last year and in line with Wall Street expectations.