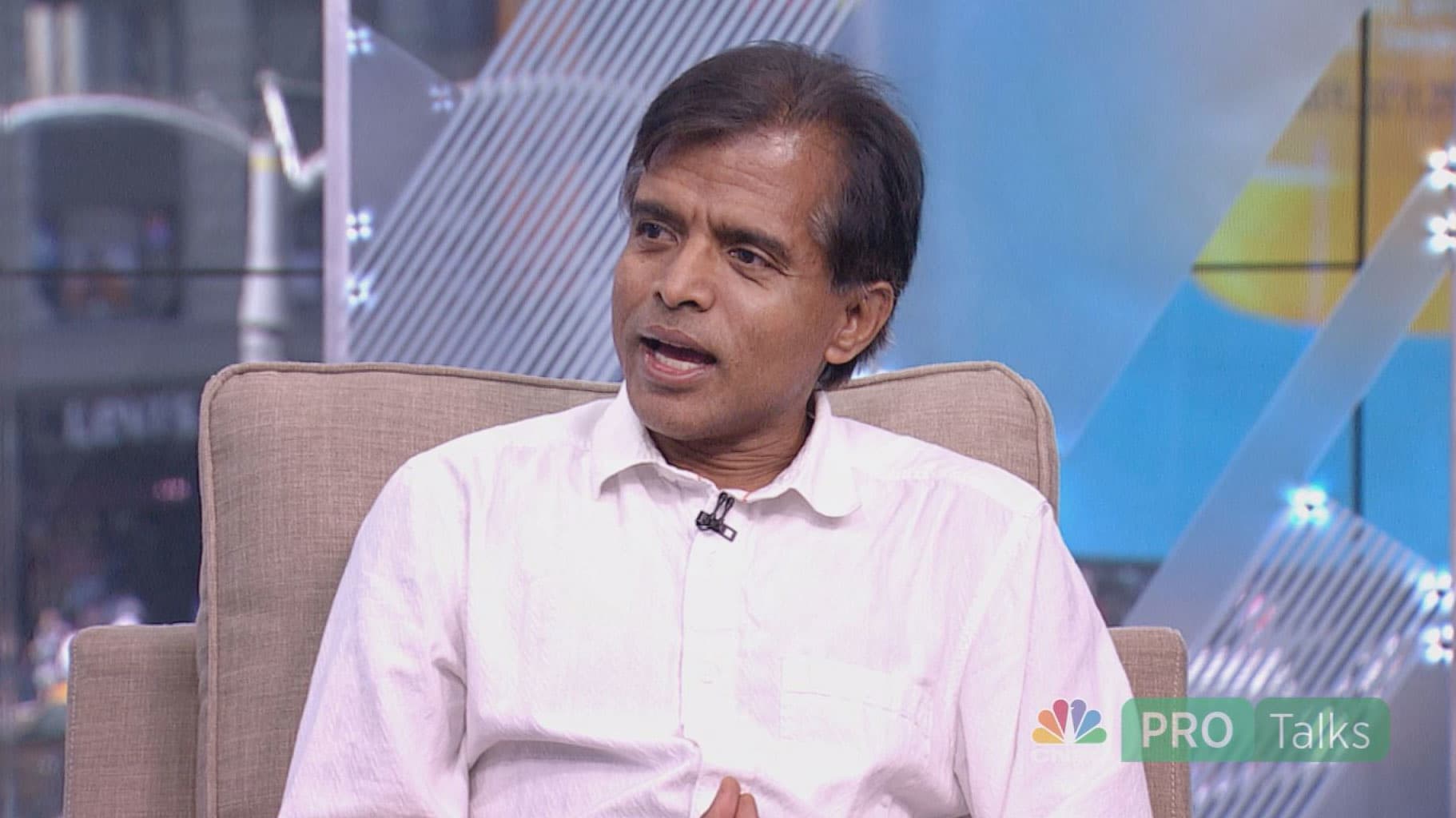

Technology stocks are likely overvalued after massive runups, according to Aswath Damodaran. The New York University Stern School of Business finance professor said tech giants including Apple , Microsoft and Alphabet have seen such large gains so far in 2023 and shares are potentially in the middle of a “boom and bust” period. “On a pricing basis, when you’ve [seen] as much of a run-up as you’ve had, you are more likely to be overvalued than undervalued,” Damodaran told CNBC’s “Closing Bell” on Thursday. “You don’t get a 40% run-up on companies of this size without expecting some degree of overvaluation.” Shares of Apple and Microsoft have each gained nearly 38% from the start of the year, while Alphabet and Nvidia have soared 53% and 216%, respectively. That wasn’t always the case, Damodaran added. As recently as January, some of the bigger players in the tech sector were skewed to an undervaluation, he said. As the end of the year approaches, the trend could shift, he said, even if investor sentiment remains strong more broadly. “I think that if the market is going to be tearing for the rest of the year, I don’t think these companies can do it,” he added.